Table of Contents

Identifying the Critical Gap in Enterprise Workflows

For years, I’ve observed a recurring chokepoint in enterprise workflows: the chaotic gap between a sales team’s enthusiasm and the finance team’s need for order. It’s the digital space where well-intentioned deals become administrative nightmares, often leading to significant revenue leakage and operational inefficiencies. Sales reps, driven by quotas, might offer non-standard discounts or bundle products in ways that break downstream financial processes, creating a ripple effect of manual corrections and reconciliation efforts. This is precisely the problem that a mature Configure, Price, Quote (CPQ) system is designed to solve.

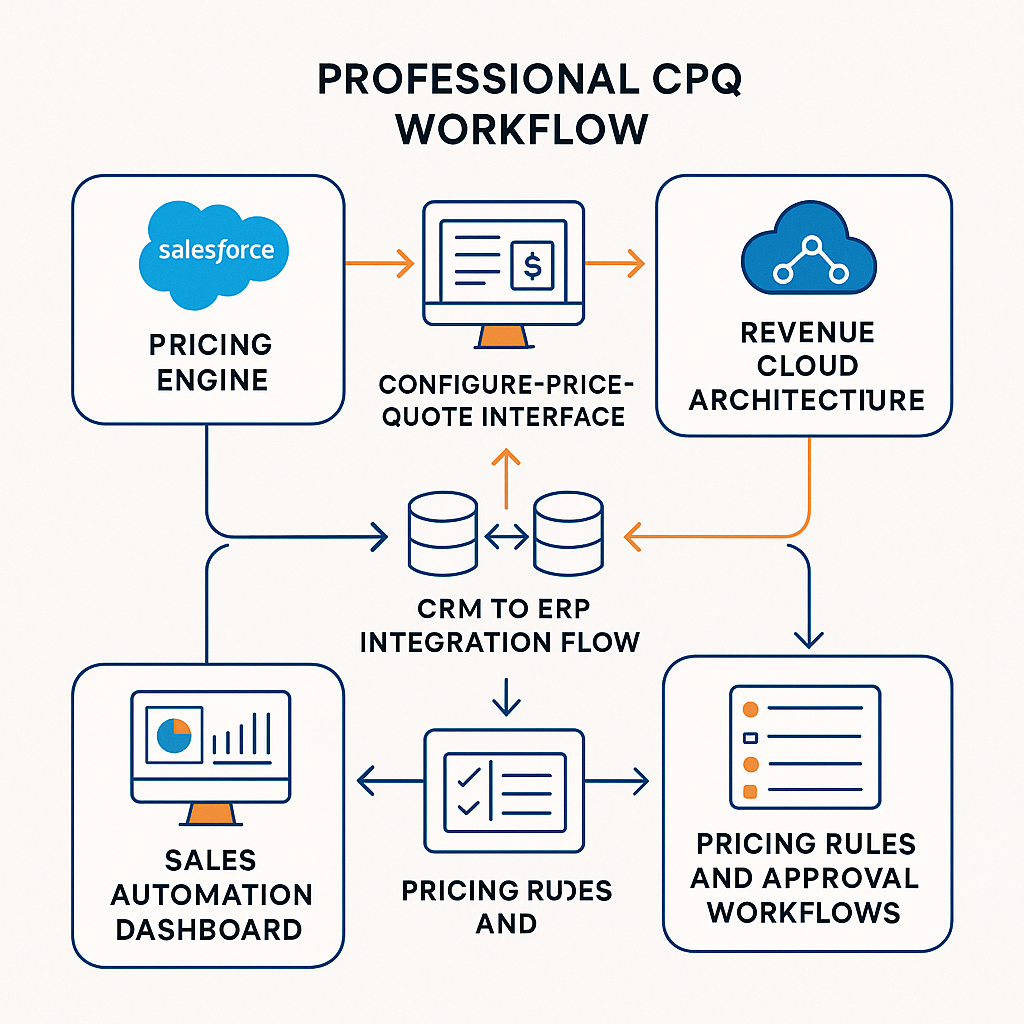

Salesforce CPQ, a core component of the broader Revenue Cloud, isn’t just a fancy quote generator. It’s better understood as the gearbox of the revenue engine. It connects the Customer Relationship Management (CRM) system, where the customer relationship lives, to the Enterprise Resource Planning (ERP) system, where the financial record is gospel. Without this disciplined translation layer, you get friction, revenue leakage, and a whole lot of manual cleanup that drains resources and delays cash flow.

From Unruly Art to Governed Science

Transforming Quoting into Governed Process

At its heart, CPQ transforms quoting from a free-form art into a governed science. A perspective forged through years of navigating real-world enterprise integrations suggests its value lies in three key areas:

Configuration Control: For companies with complex product catalogs (think manufacturing, high-tech, or professional services), CPQ enforces rules. It prevents a sales rep from selling an incompatible accessory or promising a service level that operations can’t deliver. The system guides the user through a valid set of choices, ensuring the configured product is actually buildable and supportable. This reduces errors, minimizes rework, and ensures customer satisfaction by setting accurate expectations from the outset.

Pricing and Discounting Guardrails: How many businesses truly have control over discounting? Salesforce CPQ centralizes pricing logic. It automates volume discounts, applies promotional codes correctly, and manages complex, multi-tiered pricing structures. This ensures pricing consistency across the sales organization and prevents unauthorized deviations that can erode margins.

More importantly, it establishes approval workflows. A discount above a certain threshold can automatically trigger a request to a sales manager, creating an auditable trail of pricing decisions. This level of control is vital for maintaining profitability and adhering to internal financial policies.

Contract and Order Accuracy: Beyond just pricing, CPQ ensures that the terms and conditions of a deal are accurately captured and reflected in the final quote. This includes managing subscription terms, renewal dates, and specific service level agreements. The precision here is paramount, as any ambiguity can lead to disputes, delayed revenue, or compliance issues down the line.

The Bridge to Finance and Beyond

Creating the Strategic Data Bridge

The true strategic power of Salesforce CPQ emerges when the quote is accepted. A well-implemented CPQ platform doesn’t just produce a PDF; it generates a structured data contract that can be passed directly to the ERP. This is the holy grail of the quote-to-cash process, eliminating manual data entry and the associated risks of human error.

This clean data handoff is critical for accurate invoicing, correct revenue recognition under standards like ASC 606, and streamlined provisioning. The summary data from a CPQ-generated order can inform everything from inventory demand to financial forecasting, providing a single source of truth for sales and financial performance. It eliminates the need for a finance clerk to decipher a sales rep’s notes and manually re-key an order, a process fraught with error. You move from “What did we sell?” to “This is what was sold, and here are the precise terms.” This also significantly improves auditability and reduces the time spent on month-end closes.

Ensuring Commercial Viability and Administrative Soundness

While a tool like Salesforce Sales Cloud, which I’ve analyzed in a previous article, is excellent at managing the sales process, CPQ is what ensures the output of that process is commercially viable and administratively sound. It’s a specialized engine for a specialized, and frankly, critical job. For any organization struggling with the operational drag of complex sales, a dedicated CPQ system isn’t a luxury; it’s a foundational pillar of scalable revenue operations. It enables faster deal cycles, reduces administrative overhead, and provides the financial transparency necessary for strategic decision-making.

What are your thoughts on integrating sales and finance workflows? Let’s discuss the challenges on my LinkedIn profile.