Table of Contents

The Hyperion Legacy in Modern EPM

In the landscape of Enterprise Performance Management (EPM), few names carry as much weight as Hyperion. For a generation of finance professionals, it was the gold standard for financial consolidation and reporting. That legacy is the foundation upon which Oracle has built its modern Oracle Cloud EPM suite, creating a platform that blends deep financial rigor with the advantages of the cloud.

My analysis of the EPM space reveals that while newer players have gained significant traction, Oracle’s offering remains a formidable force, particularly for large, complex, multinational organizations. Its key differentiator isn’t just a single feature; it’s the breadth and depth of its interconnected suite, which aims to cover the entire Record to Report and Plan to Perform cycles. This comprehensive approach provides a unified view of financial performance, from historical results to future projections.

A Suite Built on Financial DNA

Financial Close DNA: Built for Complexity

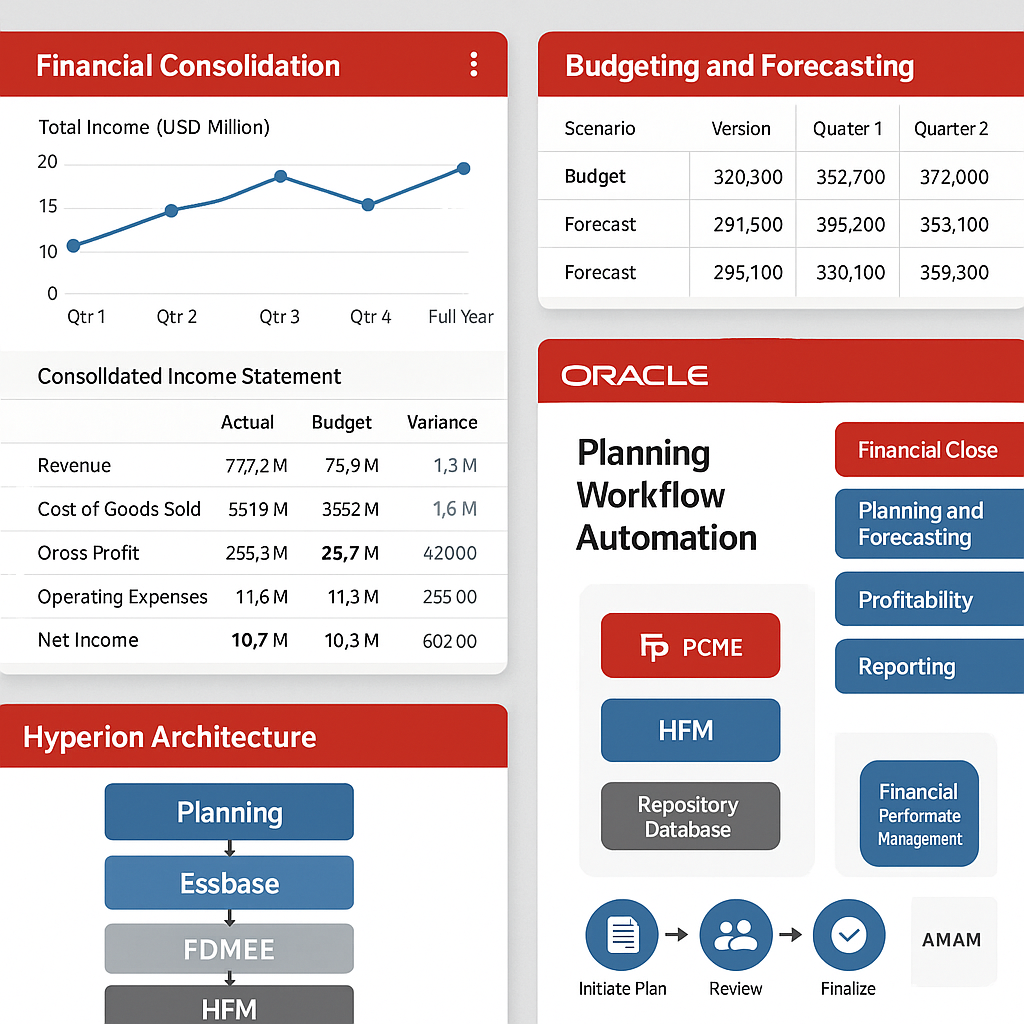

Unlike some platforms that began with a focus on flexible business modeling, Oracle EPM’s DNA is rooted in the unforgiving world of the financial close. This is most evident in its Financial Consolidation and Close (FCCS) module. This module is purpose-built to handle the specific, rules-based complexities of statutory consolidation. We’re talking about managing intercompany eliminations, handling complex currency translations (CTA), and supporting multiple accounting standards (e.g., GAAP and IFRS) in parallel. This is the heavy lifting of corporate accounting, and it’s where the platform’s Hyperion heritage shines. It’s a contrast to a platform like Anaplan, which excels at highly flexible, operational “connected planning” but traditionally requires more configuration to match the out-of-the-box consolidation power of Oracle EPM.

The “Connected” Vision

The Comprehensive Connected Suite Vision

Beyond the close, Oracle has built out a comprehensive suite that includes modules for planning, profitability and cost management, and narrative reporting. The strategic vision is to create a single, unified environment where the data from the actual close seamlessly informs the financial plan, which can then be used to model future scenarios. This integration is crucial for breaking down data silos and enabling more agile decision-making.

- Planning Module: This is Oracle’s answer to tools like Workday Adaptive Planning. It allows for driver-based budgeting and forecasting, workforce planning, and long-range strategic modeling. The module supports various planning methodologies, from top-down to bottom-up, and enables collaborative planning across departments.

- Profitability and Cost Management (PCMCS): This module helps organizations understand the true cost and profitability of their products, customers, and channels. It uses sophisticated allocation methodologies to provide granular insights, which can be invaluable for strategic pricing and resource allocation.

- Narrative Reporting: This component helps automate the production of the commentary and context that surrounds the numbers in management reports, board books, and statutory filings, integrating data directly from the EPM cubes. This streamlines the reporting process, reduces errors, and ensures consistency in financial communications.

Strategic Philosophy: Integration vs. Best-of-Breed

Implementation Complexity and Strategic Considerations

Oracle Cloud EPM implementations require significant planning and expertise. The platform’s comprehensive nature demands careful consideration of data architecture, security frameworks, and integration requirements. Organizations typically need 12-18 months for full deployment, depending on complexity and scope.

Key implementation challenges include data migration from legacy systems, user training across multiple functional areas, and establishing proper governance frameworks. The platform’s power comes with complexity: successful implementations require dedicated project management, change management expertise, and strong executive sponsorship.

Cost considerations extend beyond licensing to include implementation services, ongoing maintenance, and training. However, the total cost of ownership often proves favorable when compared to managing multiple point solutions, particularly for large organizations with complex consolidation requirements.

A perspective forged through observing many enterprise system selections suggests that the choice often comes down to philosophy. Do you prefer a single, integrated suite from one vendor that covers all aspects of EPM, or do you favor a best-of-breed approach, combining multiple specialized tools? For organizations that prioritize deep financial control and the security of a battle-tested consolidation engine, the Oracle Cloud EPM suite remains a powerful and highly strategic choice. It offers a robust, scalable, and integrated platform for managing enterprise performance, from financial close to strategic planning.

What is your experience with integrated EPM suites versus specialized planning tools? I invite you to share your views with me on LinkedIn.