Table of Contents

The month-end close. It’s a recurring ritual in every finance department, yet it often feels more like a frantic scramble than a disciplined process. The promise of modern cloud ERP systems and specialized automation tools is seductive, isn’t it? We’re sold the vision of a “push-button close,” a world where financial statements magically appear, perfectly accurate, at the stroke of midnight on the last day of the period. But how often does that actually happen?

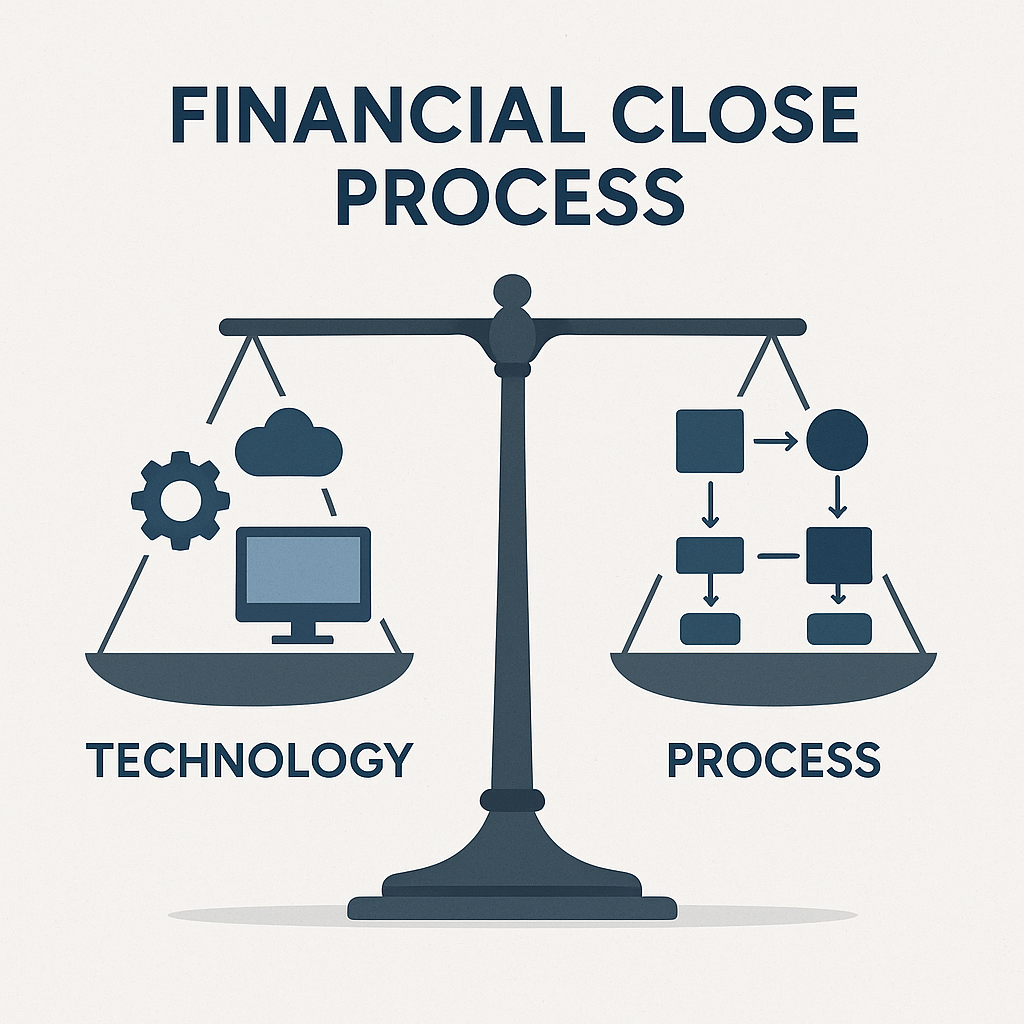

Perspectives forged through navigating and troubleshooting dozens of financial close cycles in complex enterprise environments point to a persistent and often uncomfortable truth: technology is a powerful enabler, but it’s rarely the silver bullet. The organizations that achieve a truly fast, accurate, and low-stress close aren’t necessarily the ones with the newest or most expensive technology. They’re the ones with the most disciplined processes.

The Technology Trap: Paving the Cowpaths

A common pitfall observed across the industry is what I call “paving the cowpaths.” An organization, frustrated with a slow and manual close, invests heavily in a new financial close automation tool. They implement the software, but they fundamentally fail to re-examine the underlying processes that the software is supposed to automate.

The result? They end up with a system that diligently and automatically executes a broken or inefficient process. They’ve made the chaos faster, but they haven’t addressed the root causes of the delay and rework. Insights distilled from numerous complex system deployments consistently show that technology implemented on top of a weak process foundation rarely delivers its promised ROI. The initial efficiency gains are often eroded by the need for manual workarounds and exception handling that the automation can’t manage.

It’s a Process Problem First

A truly optimized financial close is built on a foundation of process discipline. Before you even look at a new piece of software, the most effective finance leaders start by asking some hard questions about their current state:

Standardization: Are our close tasks and procedures consistent across all business units and legal entities, or is every team doing their own thing?

Sequencing and Dependencies: Have we critically mapped out the close checklist to identify the true critical path? Are there tasks being performed sequentially that could be done in parallel?

Front-Loading the Work: How many of our “month-end” activities could actually be performed during the month? This concept, often called the “continuous close,” involves shifting tasks like reconciliations and subledger reviews into the regular operational rhythm.

Materiality: Are we applying the same level of rigorous review to immaterial accounts that we do to the high-risk, high-impact ones? A risk-based approach can free up significant capacity.

Organizations that tackle these process-level questions before they implement new technology find that the technology becomes a powerful accelerator for an already-optimized process, rather than a frustrating patch on a leaky one.

The Role of Technology: An Enabler

This isn’t to say technology is unimportant. Far from it. Once the process is sound, modern tools play a critical role. A centralized close management platform (like BlackLine or FloQast) provides unprecedented visibility and orchestration. Automated reconciliation engines can eliminate thousands of hours of manual matching. And a well-configured ERP can provide the real-time data needed to perform continuous analysis throughout the period.

But the technology serves the process, not the other way around. The most successful implementations observed across the industry always start with a deep process analysis and redesign. The technology is then selected and configured to support that optimized, future-state process. It’s a subtle but profoundly important shift in mindset.

The Human Element: Beyond Numbers

We also can’t forget the human element. A faster, more efficient close isn’t just about better numbers for management; it’s about reducing the burnout and stress on the accounting team. A well-designed close process, enabled by the right technology, transforms the finance function from a group of historical scorekeepers into a team of strategic analysts who have the time and the mental bandwidth to understand what the numbers mean, not just how to compile them.

The art of the financial close, then, is a masterful blend of process discipline, strategic technology enablement, and a relentless focus on continuous improvement. It’s a journey that requires looking beyond the tools and deeply into the very mechanics of how work gets done. The companies that master this balance don’t just close faster, they close smarter.

For more insights into optimizing financial operations, I invite you to connect with me on LinkedIn.