Table of Contents

Sifting Through the RPA Buzz in Finance

Robotic Process Automation (RPA) has generated considerable discussion within finance circles over the past few years. The promise of automating repetitive, rules-based tasks sounds appealing, yet my research suggests many organizations struggle to separate the hype from genuine, high-value applications. RPA isn’t a magic wand for digital transformation, but a specific tool best suited for particular financial processes.

Understanding where RPA truly adds value requires a clear-eyed look at its capabilities and limitations within the context of complex financial operations. It’s less about replacing humans and more about augmenting their capacity by handling the drudgery.

High-Value RPA Use Cases in Finance

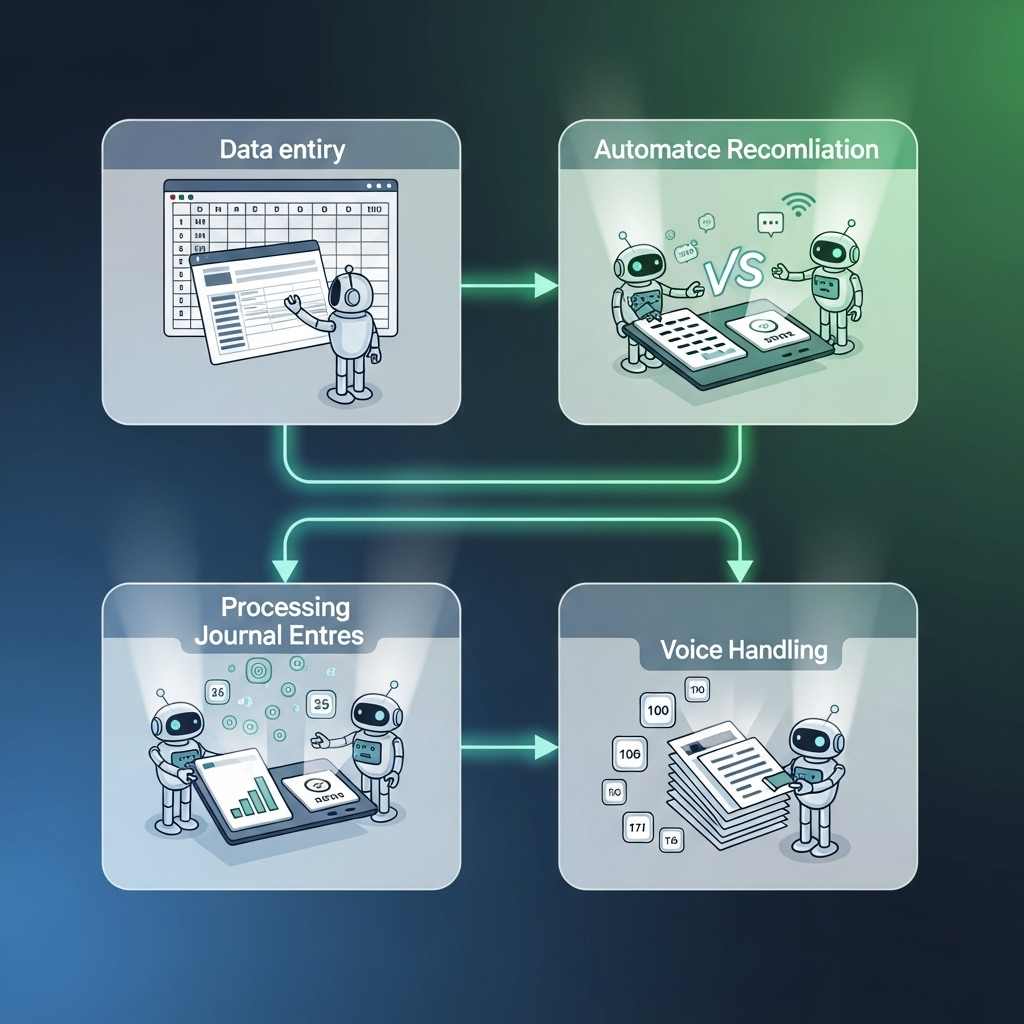

Where does RPA shine? My analysis points to several areas where software ‘bots’ can demonstrably improve efficiency and accuracy:

Automated Data Entry & Migration: This is a classic RPA sweet spot. Bots excel at transferring data between systems, such as reading invoice details from PDFs and entering them into an Accounts Payable module within an ERP like NetSuite or Acumatica. This reduces manual errors and frees up staff for validation and exception handling.

Report Generation & Consolidation: Compiling data from multiple sources for standard reports (e.g., daily cash position, month-end variance analysis) is often tedious. RPA bots can be configured to log into different systems, extract required data, consolidate it into predefined templates (often in Excel), and distribute the reports.

Account Reconciliation: While complex reconciliations still require human judgment, RPA can automate the matching of large volumes of transactions in simpler reconciliations, such as bank reconciliations or basic subledger-to-general-ledger checks. The bot flags exceptions for human review.

Intercompany Transaction Processing: Automating the creation and posting of routine intercompany journals based on predefined rules is another viable use case, particularly in organizations with high transaction volumes between entities.

Invoice Processing and Approval Routing: RPA excels at extracting data from invoice PDFs, validating against purchase orders, and routing for appropriate approvals based on predefined business rules. This reduces processing time while maintaining control frameworks.

Vendor Master Data Maintenance: Updating vendor information across multiple systems, processing new vendor setup requests, and maintaining vendor compliance documentation are well-suited for RPA automation given their structured, rules-based nature.

Quantifying RPA Value in Financial Operations

ROI Measurement Framework: Successful RPA implementations require clear metrics for measuring return on investment. Direct benefits include reduced processing time, decreased error rates, and lower staff overtime costs. Indirect benefits encompass improved compliance through consistent process execution, enhanced audit trails, and freed capacity for value-added analysis.

Cost-Benefit Analysis Approach: Organizations should evaluate RPA projects using total cost of ownership models that include licensing costs, development effort, ongoing maintenance, and change management expenses. The most successful implementations target processes with annual savings potential of at least 3-4 times the total implementation cost.

Performance Benchmarking: Establishing baseline metrics before RPA deployment enables accurate measurement of improvement. Key performance indicators include transaction processing time, error rates, manual touch points, and resource utilization metrics.

Where RPA Often Falls Short

It’s equally important to recognize RPA’s limits. Bots struggle with tasks requiring subjective judgment, interpretation of unstructured data (like complex contracts or non-standardized emails), or frequent process changes. Attempting to automate highly variable or complex decision-making processes with RPA often leads to brittle solutions that require constant maintenance. It’s not a substitute for robust system integration or true process re-engineering.

Common RPA Implementation Pitfalls

Over-Automation Syndrome: Organizations often attempt to automate processes that aren’t sufficiently standardized or stable. This leads to bots that require constant adjustments as business rules change, ultimately creating more maintenance overhead than the automation saves.

Insufficient Exception Handling: Many RPA implementations fail to adequately plan for exception scenarios. When bots encounter unexpected situations, they often fail silently or produce incorrect results, creating data quality issues that may not be immediately apparent.

Inadequate Security Considerations: RPA bots often require elevated system privileges to perform their functions, creating potential security vulnerabilities. Organizations must implement proper credential management, access controls, and monitoring to mitigate these risks.

Implementation Considerations from an Analyst’s Viewpoint

Successfully deploying RPA involves more than just selecting a tool (like UiPath, Blue Prism, or Automation Anywhere). Key considerations include:

- Process Selection: Choose stable, rules-based, high-volume processes with minimal exceptions. Thorough process analysis before automation is critical.

- Bot Management & Governance: How will bots be monitored, scheduled, and maintained? Clear ownership and governance are essential.

- Integration & Exception Handling: How will RPA interact with existing systems (often via the user interface)? How will exceptions be managed and routed to humans?

- Change Management: Prepare the finance team for changes in their roles, focusing on the shift towards higher-value analysis and exception handling.

Advanced RPA Integration Strategies

Intelligent Document Processing: Combining RPA with AI-powered document processing capabilities enables automation of more complex invoice and contract processing scenarios. This hybrid approach can handle variable document formats while maintaining the reliability of structured RPA workflows.

API Integration vs. Screen Scraping: While RPA traditionally relies on user interface automation, modern implementations increasingly leverage APIs where available. This approach provides better reliability and performance while reducing maintenance requirements when underlying systems change.

Workflow Orchestration: Advanced RPA implementations incorporate workflow management capabilities that coordinate multiple bots and human tasks within complex business processes. This orchestration approach enables end-to-end process automation while maintaining appropriate human oversight points.

Future-Proofing RPA Investments

Scalability Planning: Successful RPA programs consider long-term scalability requirements from the outset. This includes selecting platforms that can handle increased transaction volumes, implementing proper monitoring and management capabilities, and planning for bot lifecycle management.

Integration with Digital Transformation: RPA should be viewed as one component of broader digital transformation initiatives rather than a standalone solution. The most successful implementations align RPA deployment with ERP upgrades, data management improvements, and process standardization efforts.

Final Thoughts: RPA as a Targeted Tool

RPA can be a valuable addition to the finance department’s toolkit when applied strategically to the right tasks. It excels at mimicking human interaction with digital systems for repetitive, rules-based activities. However, viewing it as a panacea for all automation needs is misguided. The most significant gains often come from integrating RPA thoughtfully alongside core system improvements and deeper process optimization efforts.

What are your experiences with RPA in finance? Share your insights or connect with me on LinkedIn to discuss further.