Table of Contents

Beyond Spreadsheets: The Imperative for Integrated Fixed Asset Management

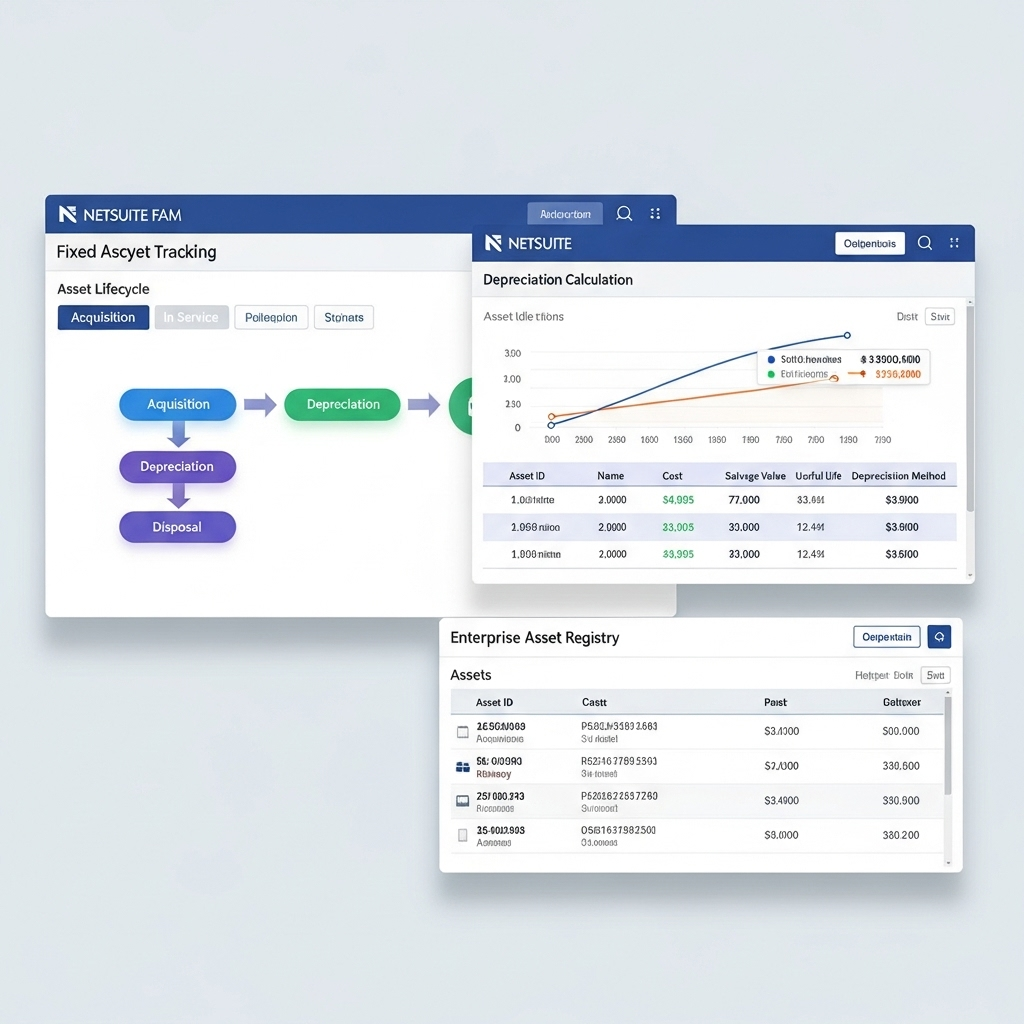

Managing fixed assets effectively often stretches well beyond the capabilities of manual spreadsheets and standalone legacy systems, especially as organizations scale and their asset portfolios grow in complexity. Tracking acquisition costs meticulously, calculating increasingly complex depreciation schedules for various accounting and tax books, managing asset disposals accurately, and ensuring ongoing regulatory compliance, these tasks demand a far more robust, integrated, and automated approach. My research, supported by observations from numerous system reviews, consistently indicates that disconnected or manual asset tracking frequently leads to material reporting inaccuracies, inefficient and stressful period-end close processes, and a lack of real-time visibility into a significant portion of the company’s balance sheet. This is precisely where integrated modules within core Enterprise Resource Planning (ERP) systems, such as NetSuite’s Fixed Assets Management (FAM) module, warrant careful and strategic evaluation.

But can an integrated system truly simplify the inherent complexities of the complete asset lifecycle, from procurement to disposal? The promise is certainly there. My observations suggest that NetSuite FAM, when properly implemented and utilized, offers several core capabilities designed to centralize control, automate tedious processes, and enhance financial reporting accuracy.

Core Capabilities: What NetSuite FAM Brings to the Table

From an analytical perspective, NetSuite FAM appears structured to handle the full lifecycle of an organization’s fixed assets. It isn’t just a simple asset register; it aims to be a comprehensive management tool. Key functionalities that are typically observed include robust asset creation and detailed tracking. This means mechanisms for automated asset creation directly from purchase orders or vendor bills within NetSuite, or flexible manual creation, capturing essential details like acquisition cost, in-service date, physical location, department, custodian, and any relevant custom classifications. This foundational data capture is critical for everything that follows.

Crucially, the module provides sophisticated depreciation management. This includes out-of-the-box support for various standard depreciation methods (like Straight-Line, Sum-of-the-Years’-Digits, various Declining Balance methods, etc.) and the ability to configure custom depreciation schedules if needed for specific asset types or regulatory requirements. The system automates the calculation and posting of periodic depreciation expenses directly to the NetSuite general ledger, which is a major time-saver and error-reducer. Furthermore, NetSuite FAM includes tools to manage the full spectrum of asset lifecycle events. This isn’t just about initial setup and monthly depreciation; it encompasses handling mid-life events such as asset revaluations, impairments, additions or improvements, and transfers between locations or departments, alongside streamlined processes for asset disposals (sale or retirement), ensuring the correct accounting treatment and gain/loss calculation for each event. Finally, it provides a suite of standard reports for asset registers, detailed depreciation schedules, asset roll-forwards, and other compliance-related information (which can potentially aid in meeting standards like ASC 842 for leased assets, especially when configured with appropriate asset types and depreciation methods). The tight integration with NetSuite’s general ledger and accounts payable modules is designed to streamline data flow, eliminate redundant data entry, and minimize the risk of manual reconciliation errors between a standalone asset system and the GL.

Strategic Benefits: Why Integrated FAM Matters

Organizations evaluating or implementing NetSuite FAM often anticipate several significant qualitative and quantitative benefits, largely stemming from its deep integration within the broader NetSuite ecosystem. The automation of depreciation calculations and journal postings directly improves accuracy by reducing manual calculation errors and eliminating the inconsistencies often found when managing assets in standalone spreadsheets or disparate systems. This enhanced accuracy naturally leads to enhanced compliance, as standardized processes, automated calculations, and readily available reporting capabilities facilitate adherence to accounting standards (like GAAP or IFRS) and streamline audit requirements.

A major operational advantage is a streamlined financial close process. By automating depreciation posting and providing consolidated, real-time asset data, the module can significantly shorten the month-end and year-end close cycles, freeing up valuable finance team resources. Moreover, centralized asset data provides better visibility and control over the entire asset base, offering clearer insights into asset utilization, physical location, maintenance history (if integrated with other modules or custom fields), and overall financial impact. This isn’t just about accounting; it’s about better asset stewardship.

Key Evaluation Considerations for NetSuite FAM

While the potential benefits are compelling, my research and field observations highlight several critical factors that organizations must thoroughly consider when evaluating a move to an integrated FAM system like NetSuite’s. These aren’t insurmountable, but they require proactive planning:

- Data Migration Complexity: Migrating historical asset data from legacy systems, disparate databases, or (most commonly) complex spreadsheets requires meticulous planning, data cleansing, and rigorous validation. Defining clear data structures for import, mapping legacy data fields to NetSuite FAM fields, and thoroughly cleansing existing data are prerequisites that are often underestimated in terms of time and effort.

- Depreciation Rule Definition and Validation: Translating existing corporate depreciation policies, as well as any specific tax depreciation rules (which may require separate depreciation books within NetSuite), into the system’s rule engine needs meticulous attention to detail. It’s crucial to ensure that all calculations align precisely with accounting standards, tax requirements, and internal policies. This often involves parallel runs and extensive validation.

- Process Re-engineering and Change Management: Implementing an integrated FAM module isn’t just a software installation; it often necessitates adapting, and ideally improving, existing business workflows for asset acquisition, capitalization, tracking, transfer, and disposal. Effective change management, including communication and stakeholder buy-in, becomes absolutely crucial for smooth adoption.

- Comprehensive User Training: Ensuring that finance, accounting, and potentially IT and procurement teams fully understand the new module’s functionality, its impact on related processes, and their specific roles and responsibilities is vital for successful adoption and realizing the full benefits of the system.

A Forward Look: Strategic Asset Control

Evaluating an integrated fixed asset management solution such as NetSuite FAM goes far beyond a simple comparison of feature checklists. It involves a deeper strategic assessment of its potential to enforce robust financial controls, significantly improve the accuracy and timeliness of financial reporting, and streamline critical accounting processes throughout the entire asset lifecycle. For organizations currently struggling with the inherent limitations, risks, and inefficiencies of manual asset tracking, the move towards an integrated system like NetSuite FAM presents a very compelling case for achieving enhanced efficiency, stronger compliance, and better overall financial governance.

What are your organization’s experiences and key considerations when evaluating or using integrated fixed asset management systems within your ERP? I encourage you to share your insights and challenges on LinkedIn.