Table of Contents

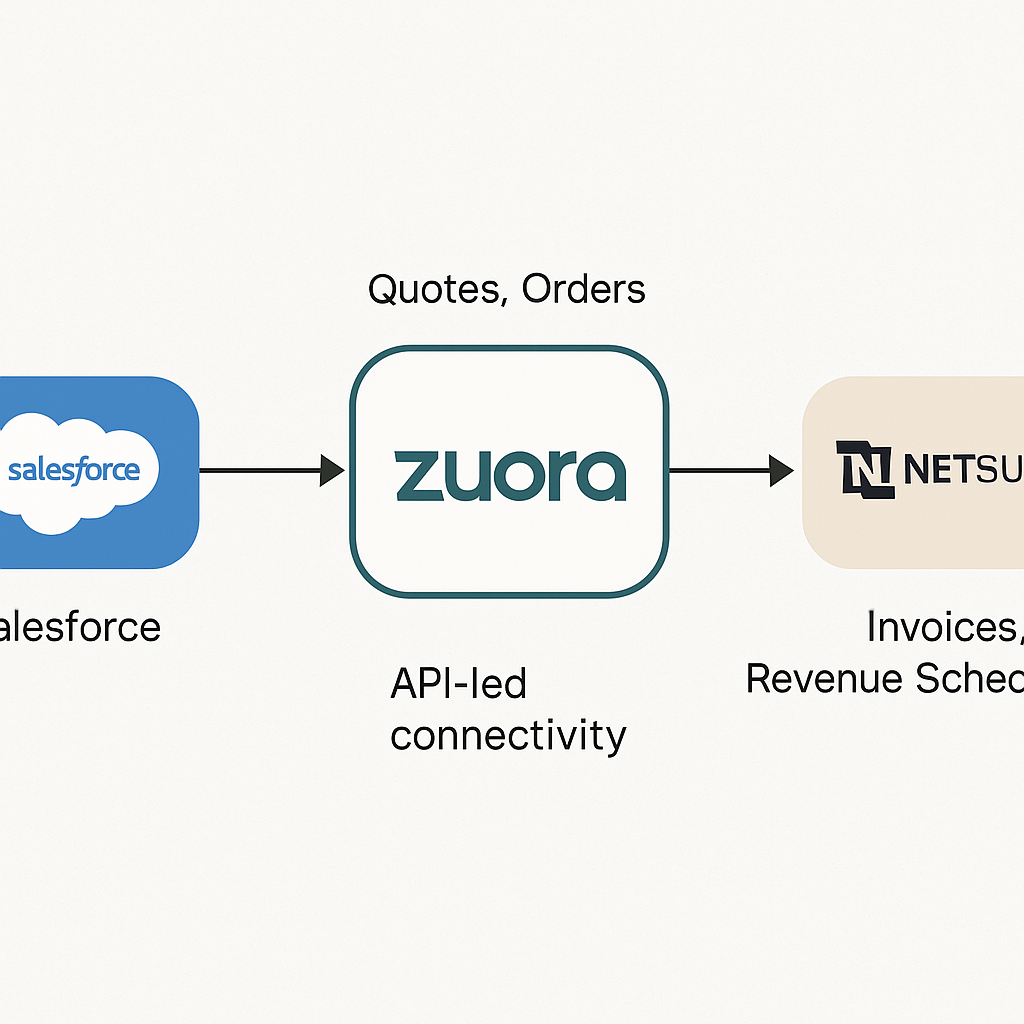

We’ve established the strategic need for a specialized engine to handle the Subscription Economy and identified Zuora as a prime example. However, a system’s true power is only realized through its integration with the broader enterprise ecosystem. Longitudinal data and field-tested perspectives highlight that a seamless flow of information between the front office and the back office is non-negotiable. So how does Zuora connect with titans like Salesforce and NetSuite to create a fully automated Quote-to-Revenue process?

The Integration Architecture

The integration architecture is conceptually straightforward but powerful in practice. It’s a chain of events, triggered by the sales process and culminating in the financial statements, with Zuora acting as the critical middleware for the subscription lifecycle. Let’s trace the data flow.

Starting Point: Salesforce

The journey starts in Salesforce. As we’ve explored in articles like the one on Salesforce Sales Cloud, this is where the sales team builds relationships and finalizes deals. Using a quoting tool, often Salesforce CPQ, a sales representative generates a quote for a new subscription or an amendment for an existing customer. When the customer accepts the quote, a business event is triggered. This is the handoff.

Through a pre-built connector or a custom API integration, the closed-won opportunity in Salesforce sends the quote details directly to Zuora. Zuora takes this information and uses it to create or update a subscription record. This is a critical step: the commercial terms defined in the sales process are translated into a financial contract that will govern all future billing and revenue recognition. The “sales” object becomes a “subscription” object, with all the associated rules for billing cycles, proration, and charges now active in Zuora’s engine.

The Financial Lifecycle Management

From this point on, Zuora manages the subscription’s financial life. It generates invoices, processes payments, and calculates the appropriate revenue schedule. But how does this get into the company’s official book of record, the ERP? This is the second key integration. Zuora doesn’t post thousands of individual transactions to the ERP’s general ledger (GL). Doing so would create an unmanageable volume of data. Instead, it summarizes the financial activity. At the end of each accounting period, Zuora generates summarized journal entries for recognized revenue, deferred revenue, cash receipts, and accounts receivable.

Final Integration: NetSuite

These summarized journals are then posted to NetSuite (or another ERP). This integration ensures that the NetSuite GL reflects the financial impact of all subscription activities without being burdened by the transactional details. The ERP remains the clean, audited system of record for the company’s financials, while Zuora handles the operational complexity of the subscription business.

Technical Implementation Considerations

The success of this three-system integration depends heavily on several technical and process design decisions that organizations must carefully consider during implementation planning.

Data Synchronization Strategy becomes critical when maintaining customer records across Salesforce and Zuora. Organizations typically establish Salesforce as the master for customer relationship data while Zuora maintains authoritative subscription and billing information. Bi-directional synchronization ensures that customer success teams in Salesforce can view current subscription status while sales teams have access to billing history for renewal conversations.

Error Handling and Recovery Mechanisms require sophisticated design given the financial implications of integration failures. Failed invoice posting to NetSuite or missed revenue recognition entries can create compliance issues and reporting inaccuracies. Successful implementations incorporate automated retry logic, dead letter queues for persistent failures, and comprehensive monitoring dashboards that provide visibility into integration health.

Revenue Recognition Timing coordination between Zuora and NetSuite demands careful attention to accounting period cutoffs and revenue recognition schedules. Organizations must establish clear processes for period-end activities, including timing of Zuora calculations, journal entry generation, and NetSuite posting to ensure accurate financial reporting within required timeframes.

Operational Benefits and Optimization Opportunities

This integrated architecture delivers several operational advantages that extend beyond simple workflow automation.

End-to-End Visibility enables sales teams to track the complete customer lifecycle from initial quote through ongoing subscription performance. Customer success managers can identify at-risk accounts based on usage patterns, payment history, and engagement metrics that flow from Zuora’s operational data back into Salesforce’s customer success tools.

Financial Forecasting Accuracy improves dramatically when Zuora’s subscription data integrates with NetSuite’s financial planning modules. Revenue forecasts can incorporate subscription renewal probabilities, expansion opportunities, and churn risk assessments to provide more accurate predictions than traditional pipeline-based approaches.

Automated Compliance Support emerges from the systematic data flow and audit trail creation across all three systems. ASC 606 revenue recognition, sales tax calculations, and regulatory reporting requirements become more manageable when supported by consistent, integrated data flows rather than manual reconciliation processes.

Governance and Change Management Requirements

Successfully operating this integrated environment requires organizational capabilities that extend beyond technical system management.

Process Standardization across sales, finance, and customer success functions becomes essential when systems share data and automate business processes. Organizations must invest in process documentation, user training, and change management to ensure that system integration benefits translate into operational improvements.

Data Governance Framework development ensures data quality and consistency across systems while establishing clear ownership and stewardship responsibilities. This becomes particularly important for customer data that exists in multiple systems and subscription metrics that impact financial reporting.

This architectural pattern, with the CRM at the front, the ERP at the back, and a specialized subscription engine in the middle, represents a robust and scalable solution for any company navigating the Subscription Economy.

For further discussion on these topics, feel free to connect with me on LinkedIn.