Table of Contents

The Overlooked Factor in Financial System Success

Implementing a new financial system, whether an ERP upgrade, consolidation platform, specialized reporting tool, or treasury management solution, represents one of the most significant and complex undertakings that organizations face in their digital transformation journeys. While technical complexities including system architecture, data migration, and integration challenges typically dominate project discussions and resource allocation decisions, my comprehensive research across diverse implementation scenarios consistently points to a frequently underestimated yet critical factor determining ultimate success or failure: change management.

Change management represents the structured, systematic approach to navigating the human dimension of technological transformation, encompassing everything from stakeholder psychology and organizational culture to communication strategies, training methodologies, and resistance mitigation techniques.

Why does this human-centered approach matter so profoundly in financial system implementations? Financial systems are uniquely embedded within core business processes, regulatory compliance frameworks, and critical decision-making workflows that directly impact organizational performance, stakeholder confidence, and competitive positioning. Unlike many other technology implementations that might affect specific departments or functions, financial system changes ripple throughout the entire organization, touching every role from data entry clerks to executive leadership.

Consequently, resistance to change, inadequate user adoption, ineffective communication, or insufficient training can rapidly derail even the most technically sophisticated and well-funded implementations, leading to significant budget overruns, extended timelines, reduced functionality utilization, and ultimately failure to realize the substantial benefits that justified the initial investment. Comprehensive analysis of both successful implementations and problematic deployments reveals several critical change management pillars that consistently differentiate high-performing projects from struggling initiatives.

Core Components of Effective Change Strategy

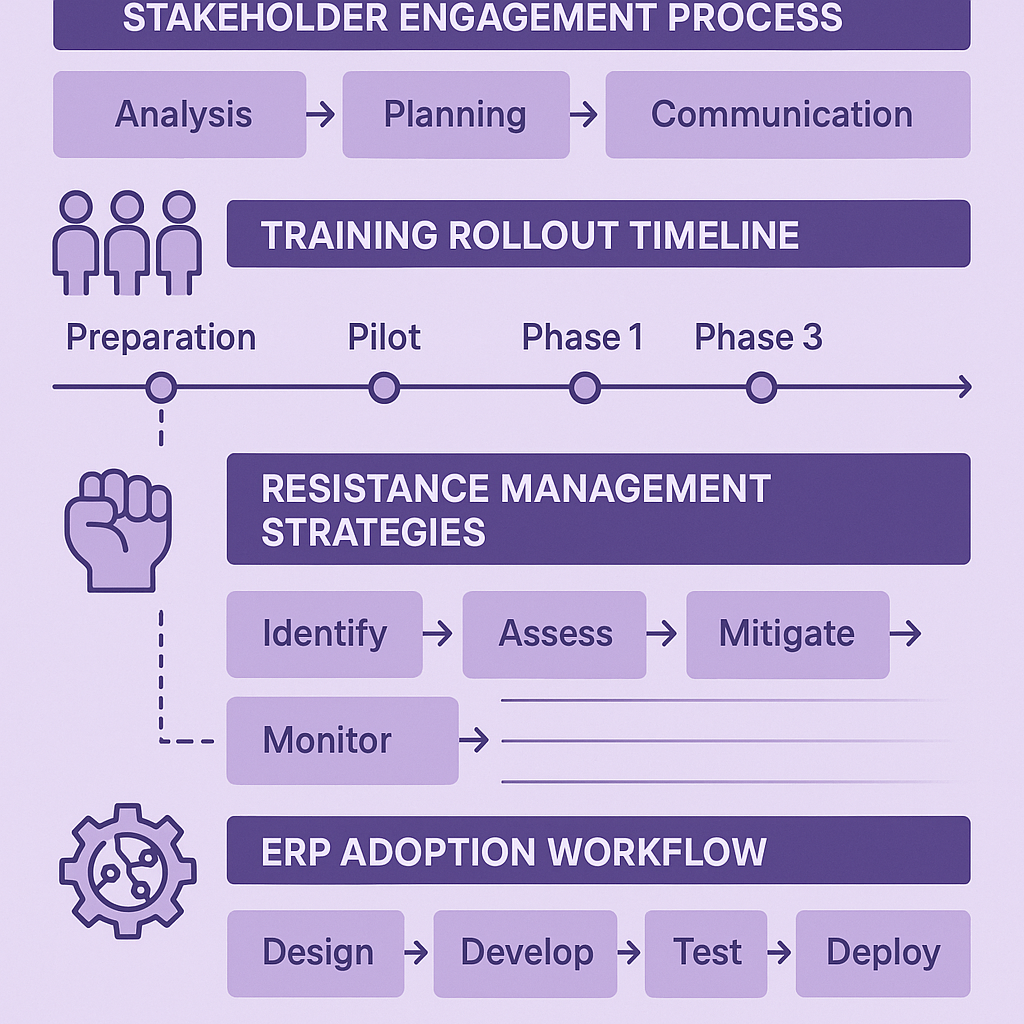

A robust change management strategy within a financial system context typically incorporates several interconnected elements:

1. Proactive Stakeholder Analysis & Engagement

This isn’t just about identifying who uses the system. It involves mapping out all affected parties (from data entry clerks to executives), understanding the specific impacts on their roles, anticipating their concerns, and tailoring engagement strategies accordingly. Early and continuous engagement builds buy-in and transforms potential detractors into advocates.

2. Strategic Communication Planning

Effective communication goes far beyond project updates. It requires a clear narrative explaining the ‘why’ behind the change, the specific benefits (both organizational and individual, if possible), the timeline, and what’s expected from users. Utilizing multiple channels (emails, town halls, intranet posts, team meetings) and ensuring consistent messaging from leadership is crucial. Silence often breeds anxiety and misinformation.

3. Targeted Training and Ongoing Support

Training must be role-specific, timely (not too early, not too late), and practical. My analysis suggests that combining formal training sessions with readily available resources like quick reference guides, eLearning modules, and identified ‘super users’ or champions within departments significantly boosts proficiency. Post-go-live support structures are equally vital for addressing inevitable questions and reinforcing new processes.

4. Addressing Resistance Systematically

Resistance is a natural part of change. Ignoring it is perilous. Effective strategies involve proactively identifying potential sources of resistance (e.g., perceived job threats, fear of the unknown, loss of established expertise), actively listening to concerns, addressing misconceptions directly, and consistently reinforcing the project’s value proposition. Sometimes, process adjustments based on valid user feedback can be powerful tools for overcoming resistance.

5. Visible Leadership Sponsorship

Executive sponsorship can’t be passive. Leaders must actively champion the change, communicate its strategic importance, allocate necessary resources, and hold individuals accountable for adopting the new system and processes. Their visible commitment sends a powerful message throughout the organization.

Advanced Change Management Methodologies and Frameworks

Sophisticated organizations increasingly leverage proven change management methodologies that provide structured approaches to managing the human dimension of financial system implementations.

Kotter’s 8-Step Process provides a comprehensive framework including creating urgency around the system change, building guiding coalitions of influential stakeholders, developing clear vision and strategy, communicating the transformation vision, empowering broad-based action, generating short-term wins, sustaining acceleration, and instituting change as part of organizational culture.

ADKAR Model Implementation focuses on individual change success through Awareness of the need for change, Desire to participate and support change, Knowledge on how to change, Ability to implement required skills and behaviors, and Reinforcement to sustain change over time.

Prosci Methodology Application combines organizational change management with individual change management, emphasizing the people side of change through structured approaches to managing change impacts on individuals while building organizational change capability.

Agile Change Management adapts traditional change management principles to modern implementation methodologies, enabling iterative feedback incorporation, rapid adjustment to changing requirements, and continuous improvement throughout implementation cycles.

Measurement and Success Metrics

Effective change management requires comprehensive measurement frameworks that track both quantitative performance indicators and qualitative success factors throughout implementation and post-deployment phases.

Adoption Rate Metrics including system login frequency, feature utilization rates, process completion times, and error reduction measurements provide objective indicators of change management effectiveness and user acceptance.

Engagement and Satisfaction Surveys capture user sentiment, training effectiveness, communication quality, and support adequacy while identifying areas requiring additional attention or resource allocation.

Performance Impact Assessment measures productivity changes, accuracy improvements, process efficiency gains, and cost reduction achievements that demonstrate successful change integration and business value realization.

Resistance Indicators and Early Warning Systems monitor help desk ticket patterns, training completion rates, manager feedback, and informal communication channels to identify emerging resistance or adoption challenges before they impact project success.

Common Pitfalls and Risk Mitigation Strategies

From comprehensive analytical perspective, several recurring pitfalls consistently emerge in financial system change management initiatives, each requiring specific mitigation strategies and organizational attention.

Treating Change Management as Afterthought represents perhaps the most common and costly mistake, where organizations invest heavily in technical implementation while allocating insufficient resources and attention to user adoption and organizational transition planning.

Generic Training and Communication Approaches fail to address role-specific needs, departmental concerns, and individual skill levels, resulting in ineffective knowledge transfer and reduced user confidence in new systems and processes.

Insufficient Leadership Engagement undermines change initiatives when executives provide only nominal support rather than actively championing transformation, communicating strategic importance, and holding teams accountable for adoption success.

Premature Victory Declarations occur when organizations assume successful technical deployment equals successful organizational change, failing to measure actual user adoption, proficiency development, and business value realization over sustained periods.

Inadequate Post-Implementation Support leaves users struggling with new processes without sufficient resources, creating frustration, workarounds, and gradual reversion to legacy approaches that undermine long-term success.

Strategic Integration and Organizational Capability Building

Ultimately, integrating sophisticated change management approaches from project inception rather than treating them as supplementary activities represents a fundamental requirement for realizing substantial investments in financial technology. This strategic integration ensures systems are not merely implemented but genuinely adopted, effectively utilized, and continuously optimized to deliver maximum organizational value.

Successful change management transforms financial system implementations from technical exercises into organizational capability building initiatives that strengthen analytical skills, improve process efficiency, enhance decision-making quality, and create sustainable competitive advantages through superior financial management capabilities.

How has your organization approached the critical people dimension of financial system transformations? What change management strategies and frameworks have proven most effective in your implementation experience? Let’s discuss proven strategies and lessons learned on LinkedIn.