Table of Contents

The Paradigm Shift to Cloud-Native Financial Platforms

Large enterprises, deep in the throes of digital transformation, frequently find themselves confronting the inherent limitations of their legacy, on-premise financial systems. These older systems, often a patchwork of acquisitions and custom code, weren’t designed for the agility and data demands of today’s global business environment. My research, drawing from numerous analyses of enterprise system deployments, indicates a clear and decisive shift towards cloud-native platforms. These platforms are engineered specifically for scalability, flexibility, and real-time data access. Workday Financials consistently emerges as a prominent player in this landscape, frequently shortlisted by organizations aiming to modernize their core accounting functions and drive greater financial insight. But what truly underpins its capabilities, especially when dealing with the intricate demands of complex, global operations? It isn’t just about being in the cloud; it’s about architectural philosophy.

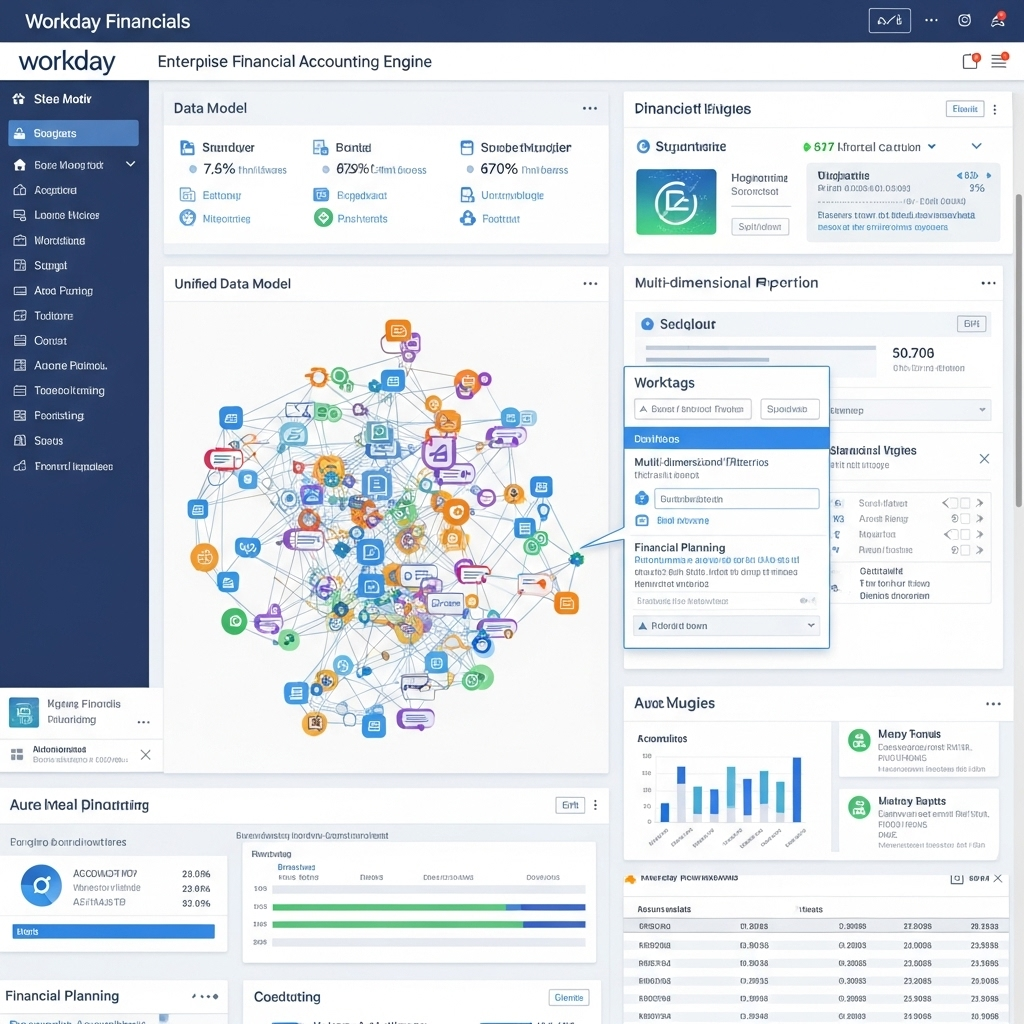

Unlike many traditional ERP systems that were often “bolted together” through years of acquisitions and disparate technological foundations, Workday was, quite notably, engineered from the ground up with a unified architecture. This foundational difference isn’t just a technical talking point; it’s crucial to understanding its operational strengths. Its core accounting engine operates on an object model, representing business events (like a supplier invoice or a customer payment) and financial transactions in a far more flexible and less constrained manner than the rigid, chart-of-accounts-centric legacy systems many are still grappling with. This inherent flexibility can, in theory, allow for more dynamic and multidimensional reporting using its Worktags system, without the structural handcuffs and painful re-engineering efforts often seen elsewhere when reporting needs evolve.

Examining Workday’s Core Accounting Engine: The Power of Unity

Workday Financials positions its “Accounting Center” as the operational hub for all core financial processes. This encompasses the general ledger, accounts payable, accounts receivable, fixed asset management, and cash management. The central promise, and a compelling one at that, is data consistency born from a single source of truth. Because all these financial modules share the same underlying data model and, indeed, the same instance of data, the perennial and often nightmarish challenge of reconciling subledgers to the general ledger is, at least theoretically, minimized or even eliminated. Information entered or generated in one functional area (say, a supplier invoice in AP) should, in principle, flow consistently and instantaneously across the entire platform, updating relevant balances and reports without batch processes or manual interventions. But does this utopian vision always hold true? We’ll get to that.

Key capabilities that are consistently highlighted in industry analyses and my own research include:

- Unified Data Model: This is arguably Workday’s most discussed and potentially transformative feature. Instead of separate modules with their own distinct databases and integration points (which are often points of failure or data lag), financial data, Human Capital Management (HCM) data, and even planning data (through Workday Adaptive Planning) reside, or can reside, together within the same system. This architectural choice is designed to facilitate real-time, cross-functional reporting and analytics without the need for complex, costly, and often slow data warehousing efforts to stitch everything together. The potential advantage for achieving holistic business insight and making faster, more informed decisions is significant. Is the integration truly “seamless” in every practical scenario? The answer, as with many enterprise systems, often depends on the rigor of the implementation, data governance practices, and the complexity of the specific business processes involved.

- Worktags for Advanced Dimensional Reporting: Workday moved away from the traditional, often restrictive, segmented charts of accounts. Instead, it employs Worktags. These allow organizations to tag transactions with a multitude of business dimensions (e.g., cost center, department, project, fund, region, product line, customer segment). This offers tremendous flexibility in slicing and dicing financial and operational data for analysis, moving far beyond the typical limitations imposed by fixed Chart of Account (COA) structures. Need to see profitability by a new service line combined with a specific customer demographic? With well-designed Worktags, this becomes achievable without reconfiguring the COA. However, this power comes with responsibility. The primary challenge, as many organizations discover, lies in establishing robust governance around Worktag creation, maintenance, and usage to avoid uncontrolled proliferation (i.e., “tag soup”) and maintain data consistency and comparability over time.

- Continuous Audit and Real-Time Visibility: The unified ledger and the event-based architecture mean that every financial transaction and business event is captured with a rich audit trail. Because every transaction is inherently linked through the object model, tracing financial events back to their operational source (e.g., from a GL balance to the underlying procurement requisitions and approvals) can be significantly streamlined. This has the potential to simplify both internal and external audit processes, reduce manual effort in gathering audit evidence, and support continuous monitoring of controls, as opposed to periodic, after-the-fact reviews common with older systems.

Considerations for True Enterprise Scale and Complexity

Workday Financials is almost exclusively considered by larger, often global, enterprises. Its architecture, with its inherent support for multi-entity, multi-currency, multi-book accounting, and complex consolidation requirements, appears well-suited for these demanding environments. The unified nature of the platform is designed to simplify processes like intercompany transaction processing and facilitate global reporting standardization, which are common pain points for multinational corporations.

However, it’s not without potential analytical challenges and operational considerations. While Worktags offer remarkable reporting flexibility, extracting and manipulating extremely large datasets for highly specialized, ad-hoc, or exploratory data analysis might still necessitate the use of dedicated BI and analytics tools, even with Workday’s own evolving reporting capabilities (like Workday Prism Analytics and Workday Extend). Organizations must critically evaluate if the native reporting and analytical tools sufficiently meet the demands of their most complex or niche analytical use cases, or if an ecosystem of external tools will still be a necessary complement. Furthermore, the platform’s extensive configurability, while a strength, also means that it necessitates significant internal expertise or a continued reliance on skilled implementation partners and consultants. This represents an ongoing operational cost and a need for continuous learning as the platform evolves.

Strategic Evaluation Framework for Enterprise Adoption

From a seasoned systems perspective, Workday Financials presents a compelling and modern architectural approach to large-scale financial management. Its core strengths undoubtedly lie in its genuinely unified data model and the flexible, dimensional reporting enabled by Worktags. Organizations that are evaluating Workday should focus intensely on validating the real-world efficacy of its integrated reporting and analytics for their specific, critical business needs. They must also ensure they have, or can build, the internal governance structures and skillsets required to manage its powerful flexibility effectively and avoid potential pitfalls down the line. It’s a powerful system, but power needs careful handling.

What are your observations on the evolution of cloud-native financial platforms and their impact on enterprise accounting? I encourage you to connect with me on LinkedIn to share your valuable perspective and experiences.