Table of Contents

Choosing the Right HCM Platform for Mid-Market Growth

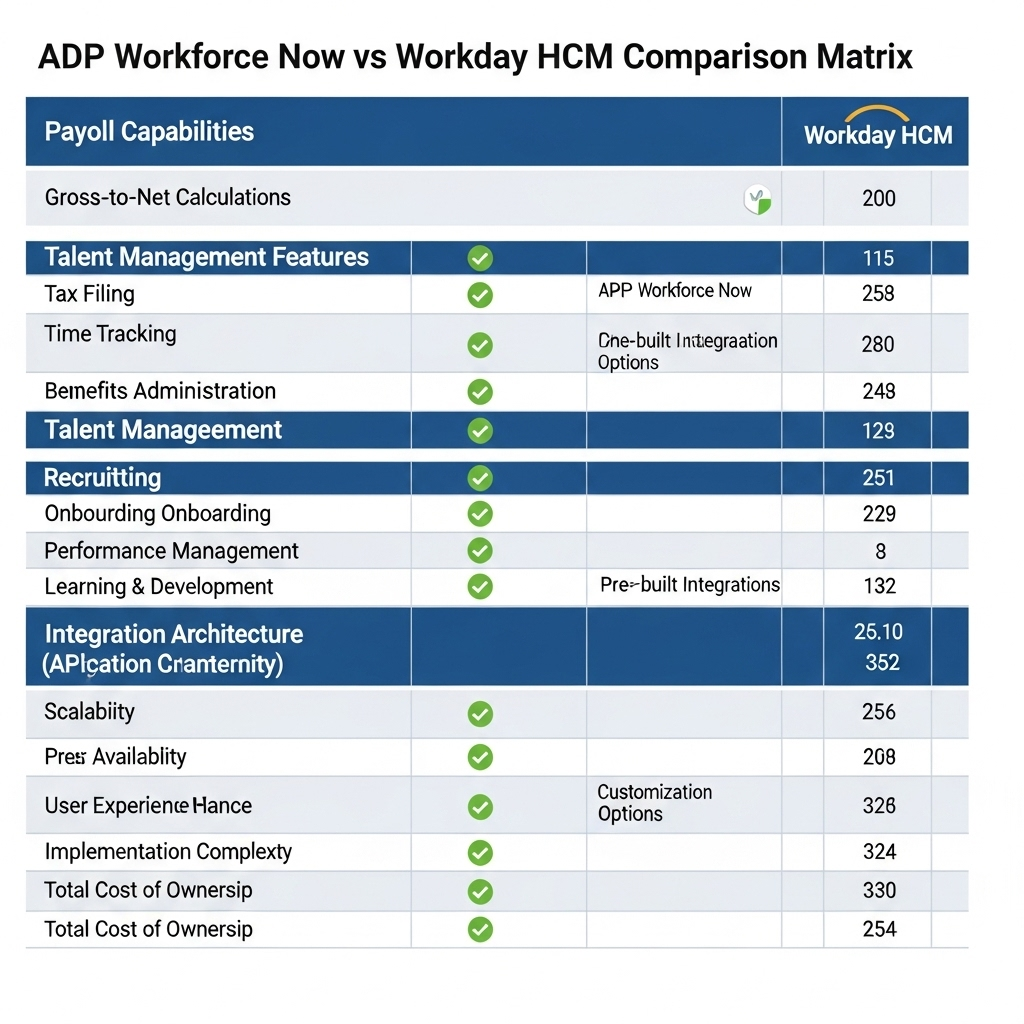

Selecting the right Human Capital Management (HCM) and payroll platform is a critical decision for mid-market companies aiming for growth. These systems form the backbone of employee management and compensation, directly impacting operational efficiency and compliance. Two prominent players often considered are ADP Workforce Now and Workday HCM. While both offer robust solutions, my research suggests they cater to slightly different strategic priorities within the mid-market space.

Understanding the architectural philosophies and core strengths of each platform helps clarify which might be a better fit for a specific organization’s trajectory and complexity. It’s not just about features; it’s about alignment with business processes and future integration needs.

ADP Workforce Now: Scalability and Payroll Expertise

ADP Workforce Now has built a strong reputation, particularly for its deep expertise in payroll processing and compliance across various jurisdictions. For many mid-market firms, especially those with complex payroll scenarios or operating across multiple states, ADP’s specialized focus offers significant advantages.

Its strengths often lie in:

- Payroll Engine: ADP’s core strength remains its powerful and reliable payroll processing, backed by extensive compliance knowledge.

- Scalability: Workforce Now is designed to scale with growing mid-market companies, offering modular components that can be added as needs evolve (HR, benefits, talent, time).

- Integration: While offering its own suite, ADP provides established connectors and APIs for integration with various financial systems, which I’ve analyzed in previous research.

However, the user experience and the integration depth across its own modules sometimes receive mixed feedback compared to platforms built on a unified data model from the ground up.

Workday HCM: Unified Architecture and Talent Focus

Workday HCM, often perceived as an enterprise solution, also has a presence in the upper mid-market. Its primary differentiator is its unified architecture (a single system for HR, payroll, finance, and planning built on one object model). This can offer significant benefits for data consistency and real-time reporting.

Key considerations include:

- Unified Data Model: Enables seamless data flow between HR, payroll, and potentially finance (if using Workday Financials), simplifying reporting and analytics. I’ve explored Workday’s financial capabilities previously.

- Talent Management: Workday often receives high marks for its talent acquisition, performance management, and learning modules, offering a more integrated talent lifecycle experience.

- User Experience: Generally praised for a modern, intuitive interface across its modules.

The potential challenge for some mid-market companies might be the perceived complexity and cost compared to ADP, especially if their primary need is robust payroll without the extensive talent suite or a full platform unification strategy immediately.

Key Differentiators for Mid-Market Selection

The choice often hinges on strategic priorities. For instance, Payroll Complexity is a major factor; for intricate, multi-state payroll needs, ADP’s specialized engine might be preferable. The desired Platform Strategy also plays a role: if aiming for a fully unified HCM/Finance platform eventually, Workday’s architecture holds appeal. Furthermore, Talent Management Needs can steer the decision, as organizations prioritizing integrated talent development might lean towards Workday. Finally, Budget and Implementation considerations are key, where ADP might offer a more phased, potentially less costly initial implementation for core HR/payroll needs.

It’s crucial to analyze not just current requirements but also the company’s 3-5 year growth plan, potential M&A activity, and the desired level of integration between HR/payroll and finance. There isn’t a single “best” answer; the optimal choice depends heavily on organizational context and strategic direction.

Technical Architecture Considerations

The underlying technology architecture of each platform creates different implications for mid-market organizations. ADP Workforce Now operates on a modular architecture that allows organizations to implement components incrementally. This approach provides flexibility for phased deployments but can introduce integration complexity between modules that weren’t originally designed as a unified system.

Workday HCM leverages a unified object model that treats all HR data as interconnected entities within a single database structure. This architecture eliminates many integration challenges but requires organizations to adopt Workday’s prescribed data model and business processes, which may necessitate more significant process changes during implementation.

Integration and API Capabilities

Mid-market organizations increasingly require seamless integration with financial systems, time tracking solutions, and third-party benefits providers. ADP’s integration strategy focuses on pre-built connectors and APIs that facilitate connections with popular business applications, particularly emphasizing payroll-to-GL integration patterns that many finance teams require.

Workday’s API framework provides comprehensive access to its unified data model through REST and SOAP APIs, enabling sophisticated data synchronization scenarios. However, the complexity of Workday’s data model may require more technical expertise to implement and maintain these integrations effectively.

Implementation and Change Management Patterns

Successful platform implementations require careful attention to organizational change management. ADP implementations often follow familiar patterns for organizations with existing payroll systems, as the core payroll concepts remain consistent. This familiarity can accelerate user adoption but may limit opportunities for process improvement.

Workday implementations typically require more comprehensive business process analysis and redesign, as organizations must align with Workday’s unified approach to HR data and workflows. While this creates more upfront change management requirements, it often results in more streamlined and automated processes post-implementation.

How does your organization approach HCM and payroll platform selection? Share your insights or connect with me on LinkedIn to discuss further.